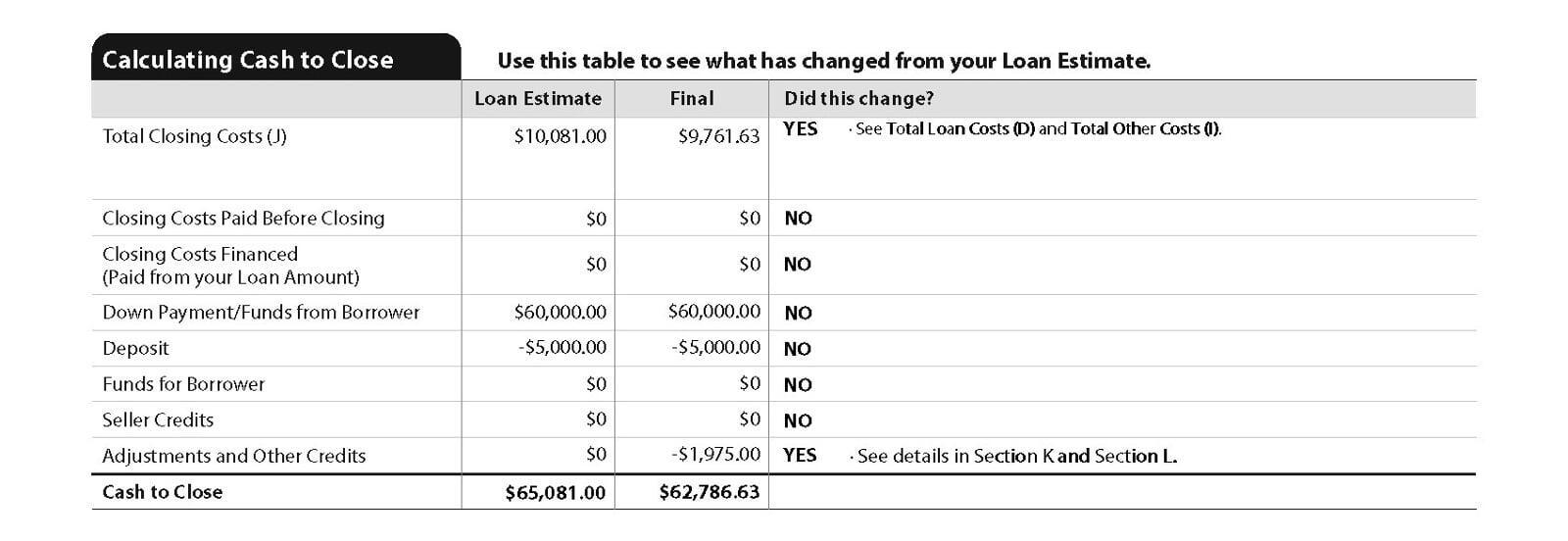

When you're nearing the final steps of purchasing a home, you'll encounter the term cash to close. It's essential to understand what this means, how it's calculated, and why it's a critical component of the homebuying process.

What Is Cash to Close?

Cash to close refers to the total amount of money a ...

05.22.25 02:57 PM - Comment(s)