Matthew Becker

Blog by Matthew Becker

07.07.25 06:36 AM - Comment(s)

When it comes to low- or no-down-payment mortgage options, FHA and VA loans are two of the most popular government-backed programs in the U.S. But they’re designed for very different types of borrowers—and knowing which one fits your situation can save you thousands in the long run.

In this post, w...

06.26.25 07:26 AM - Comment(s)

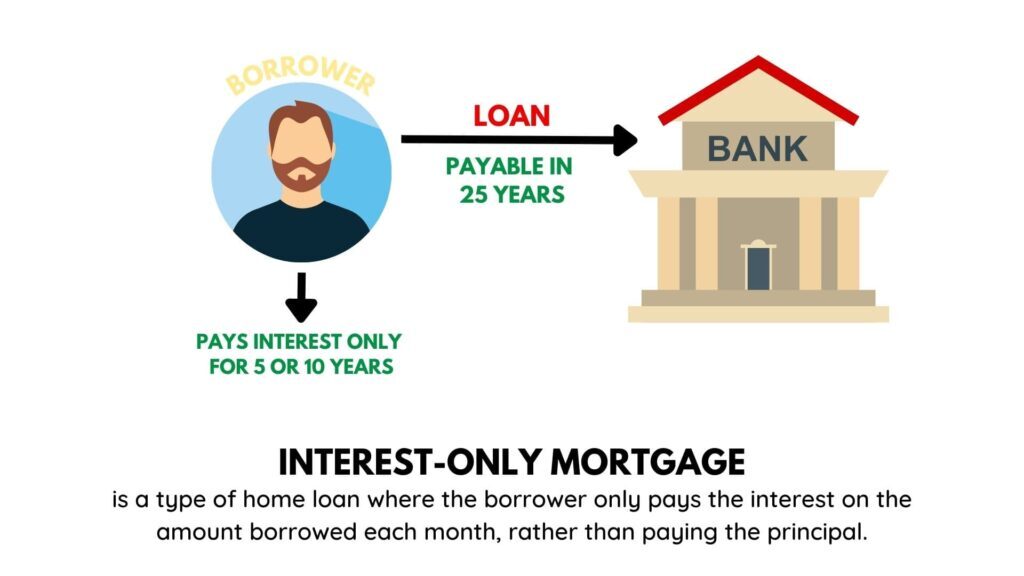

Explore the pros and cons of interest-only mortgages, who they’re best suited for, and how they compare to traditional home loans. Understand if this strategy fits your financial goals.

06.25.25 12:31 PM - Comment(s)

If you've ever been turned down for a traditional mortgage or felt boxed in by rigid lending rules, a portfolio loan might offer a solution that fits your unique financial situation.

Unlike most conventional loans that are sold to third parties like Fannie Mae or Freddie Mac, portfolio loans stay wi...

06.24.25 08:00 AM - Comment(s)

Discover what a Non-QM (Non-Qualified Mortgage) loan is, who it’s best suited for, and how it compares to traditional loan options. Learn if a Non-QM loan might be right for your unique financial situation.

06.23.25 09:03 AM - Comment(s)

Categories

- Uncategorized

(38)

Tags

- Sample

- mortgage insurance, PMI, home loan, mortgage tips, real estate finance, mortgage planning, homeownership costs

- APR, Annual Percentage Rate, mortgage, closing costs, underwriting, APR charges, estimates, ARM, adjustable mortgage, adjustable rate mortgage

- dscr loans mortgage alternatives unconventional mortgages mortgage qualification

- mortgage for self-employed real estate investor loans DSCR loans foreign national mortgage unique property financing bad credit mortgage

- second opinion on your mortgage

- loan review service, second opinion mortgage, mortgage offer breakdown, real estate loan analysis

- how lenders make money, mortgage commissions, hidden loan fees, mortgage profit, refinance costs

- closing costs explained, mortgage closing fees, unnecessary closing costs, loan estimate fees, junk mortgage fees

- how to read a loan estimate, understanding loan estimate, mortgage loan estimate explained, loan estimate breakdown

- APR vs interest rate, mortgage APR explained, difference between APR and interest rate, real mortgage cost

- escrow in mortgage, property taxes and insurance mortgage, monthly mortgage payment breakdown, what’s in a mortgage payment

- mortgage points explained, discount points mortgage, should I buy mortgage points, paying points vs higher rate

- balloon payment mortgage, prepayment penalty, hidden loan terms, mortgage fine print, real estate loan traps

- hidden mortgage costs, costly loan terms, overpaying on mortgage, mortgage savings tips, second opinion mortgage